London-based Unilever CEO, Hein Schumacher, conveyed that Nelson Peltz, a billionaire activist and board member, supports the recently formulated strategy to rejuvenate the company. This backing from Peltz comes in the face of lingering skepticism among certain investors due to years of industry underperformance.

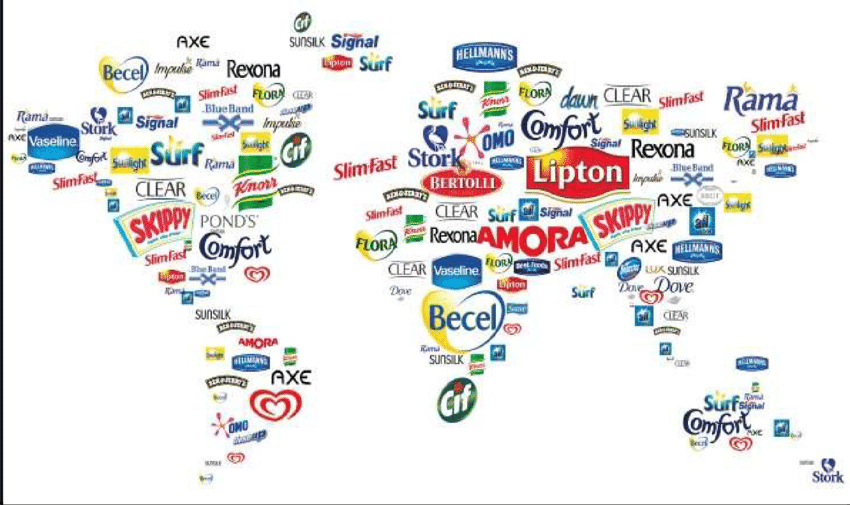

In an interview with Reuters, Schumacher expressed his desire for Unilever, renowned for brands like Dove, Hellmann’s, and Ben & Jerry’s, to adopt a “systematic” marketing approach for its flagship products. The 52-year-old Dutch executive is also unwavering in his commitment to streamline Unilever’s substantial workforce of 127,000 employees.

Predecessor Alan Jope faced criticism for allowing the company’s brand portfolio to burgeon to approximately 400, leaving insufficient focus on high-performing brands. Investors were discontented with Unilever’s inability to recover margins post-pandemic and its perceived overemphasis on sustainability, as noted by Fundsmith’s Terry Smith.

Following Unilever’s fourth-quarter earnings report, critics voiced concerns over the slow recovery of lost market share and declining margins. Peltz’s involvement became evident in January 2022, as his Trian Partners investment fund built a stake in Unilever, eventually earning him a seat on the board in July of that year, with a 1.45% stake as of March 2023.

Jope’s departure was announced in September 2022, paving the way for Schumacher to assume the role of CEO in July the following year. Schumacher acknowledged Peltz’s dissatisfaction with the company’s performance, noting Peltz’s strategic investment based on perceived potential.

According to Schumacher, Peltz’s perspectives align closely with Unilever’s growth strategy. This strategy involves increased investment in the top 30 brands, constituting over 70% of sales, support for the innovation pipeline, and a focus on enhanced operating discipline.

Peltz appreciates Unilever’s business line categorisation, mirroring Trian’s influence at P&G, contrasting with Nestle’s regional structure. When questioned about the possibility of spinning off the food business, Schumacher expressed openness but emphasised the current priority of executing the growth action plan.

Unilever initiated a €1.5 billion ($1.6 billion) share buyback following increased volumes for the first time in 10 quarters. Schumacher’s association with Peltz dates back to their time at HJ Heinz during the merger with Kraft Foods, and Peltz welcomed Schumacher’s Unilever CEO appointment.

Schumacher’s key priorities involve instigating “performance culture changes,” leading to a reshuffling of the leadership team. Esi Eggleston Bracey, appointed as head of growth and marketing officer, is tasked with developing a clear two-to-three-year roadmap for market expansion of Unilever’s top brands.

Despite initial disappointment among some investors regarding Schumacher’s strategic plans, he is now focused on addressing concerns and implementing corrective measures. Schumacher recognizes that history will ultimately judge the success or failure of his tenure as Unilever’s CEO.