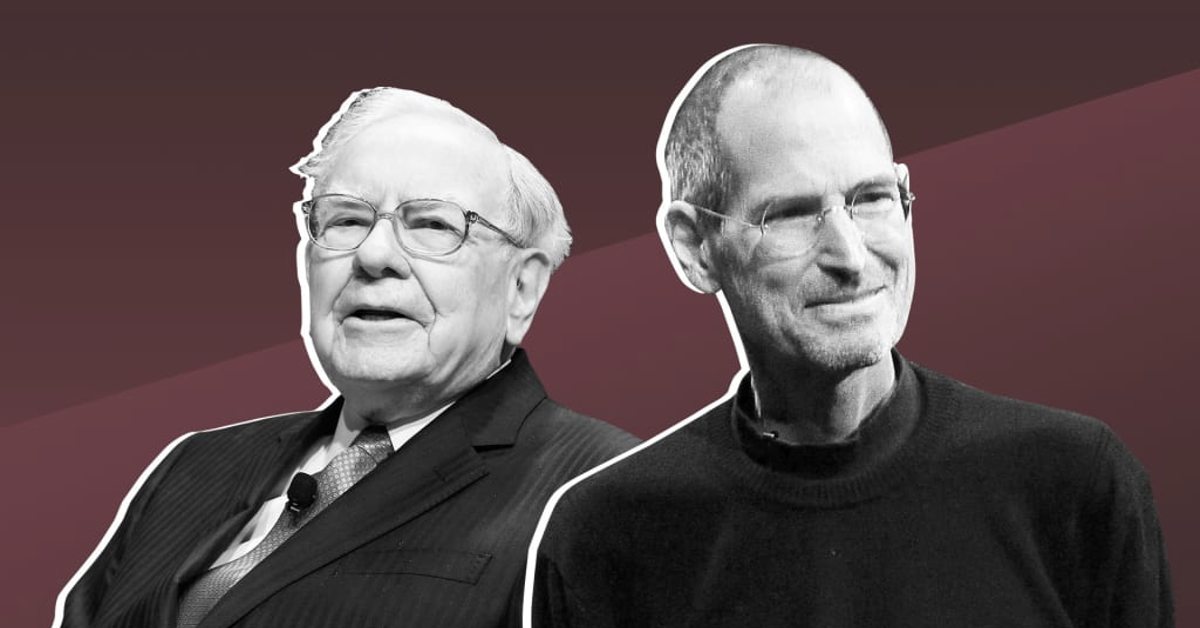

During a 2012 appearance on CNBC’s “Squawk Box,” Warren Buffett discussed a conversation he had with Steve Jobs about Apple Inc.’s financial strategy.

In the “Ask Warren” segment, Buffett mentioned that Jobs reached out to him, seeking advice on what to do with the company’s substantial cash reserves. Jobs, the visionary behind Apple’s global success, wanted insights into cash-management strategies.

Buffett, renowned for his investment acumen, outlined the options: stock buybacks, dividends, acquisitions, or retaining the cash. Despite Jobs acknowledging the undervaluation of Apple’s stock, he opted not to take any immediate action, choosing to maintain the company’s cash reserves instead.

Buffett recalled discussing the logic behind each option and Jobs expressing his belief in the undervaluation of Apple’s stock. Ultimately, Jobs favored holding onto the cash, viewing it as the best course of action.

Buffett later learned that Jobs interpreted their conversation as an endorsement of his decision to retain the cash. This exchange reflects a cautious approach to financial management, differing from the more aggressive stance taken by Jobs’s successor, Tim Cook.

Under Cook’s leadership, Apple has pursued significant stock buybacks, surpassing $500 billion over the last decade. This strategy has bolstered shareholder value and increased Berkshire Hathaway’s stake in Apple.

Buffett has publicly supported Apple’s buyback efforts, recognizing their positive impact. While Jobs prioritized liquidity and financial flexibility, Cook has capitalized on Apple’s financial strength to actively manage its capital structure, reinforcing its position as a technology leader and delivering value to shareholders and stakeholders alike.